Strengthening Mid-Career Support with SkillsFuture Level-Up Programme

The new SkillsFuture Level-Up Programme will provide greater structural support for mid-career Singaporeans aged 40 years and above to pursue a substantive skills reboot and stay relevant in a changing economy.

Learn more

New Jobs-Skills Integrators to strengthen training and job matching

More coordinated support for companies and individuals to navigate training and placement offerings

Learn More

New scheme to help build workplace learning capabilities

Workplace Skills Recognition programme for Enterprises allows employees to gain formal recognition of skills learnt at work without need for external training

Learn More

LATEST NEWS

Latest Annual Skills Report Spotlights Evergreen Skills, Forecasts Future Demand, and Identifies Career Growth Pathways

Learn More

FEATURED INITIATIVE

Course Fee Funding and Eligibility

Registering for a SSG-approved course? Find the funding support available for you.

Learn MoreFEATURED INITIATIVE

New SkillsFuture Jobs-Skills Insights for HR professionals

The publication highlights the importance of a skills-first approach over traditional qualifications to foster a competitive and adaptable workforce, and the skills required by HR professionals to drive the shift towards skills-centric assessments.

Learn More

FEATURED INITIATIVE

Courses to Support Caregivers Training

To better equip caregivers, Agency for Integrated Care (AIC) and SkillsFuture Singapore (SSG) have prepared a AIC-SSG Caregivers Training Catalogue to guide caregivers in finding suitable courses to pick up relevant skills.

Learn MoreFEATURED CAMPAIGN

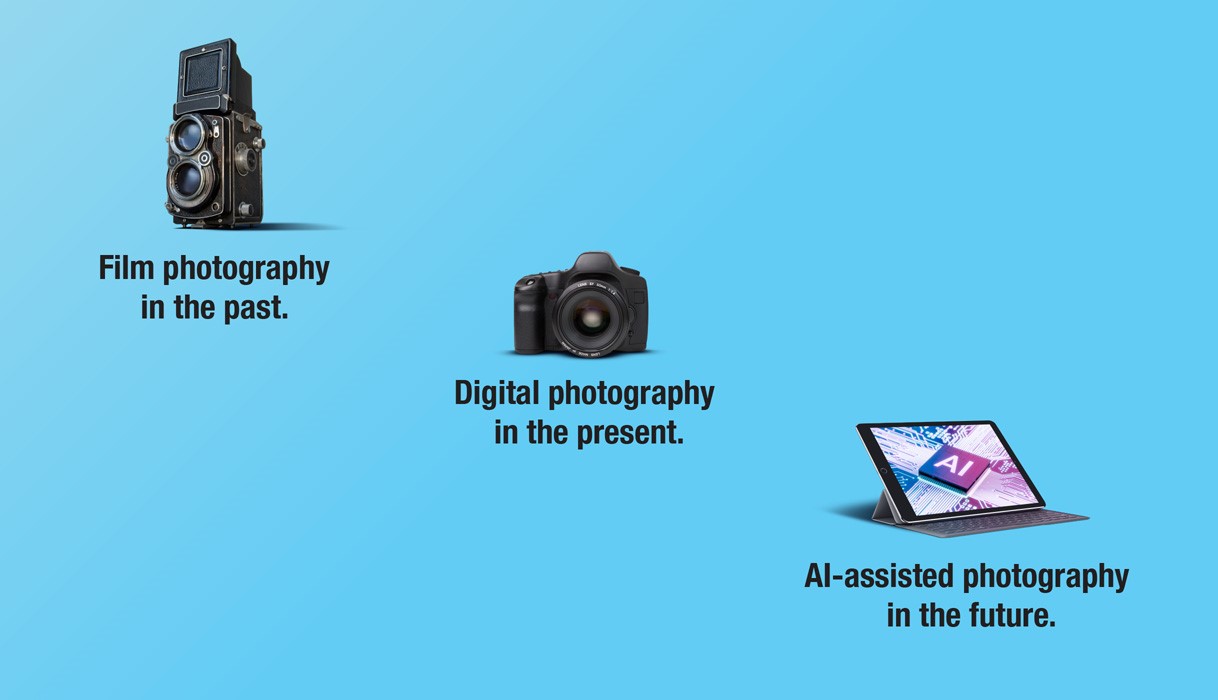

When Jobs Evolve, New Skills Are Needed

Secure your future by acquiring the right skills!

Learn More